Should I Buy Bitcoin now? Bitcoin price prediction for 2024!

Bitcoin is the largest currency unit and dominates the entire world of crypto. Therefore, it is also the most sought-after cryptocurrency, leading to its status as the highest valued digital currency.

As of May 2024, the highest peak of Bitcoin has reached about $73,000. However, its price still fluctuates unpredictably. So, “should I buy Bitcoin now?” Let’s analyze through the following article.

Readers should remember that this is an assessment based on historical data and market analysis. This is not an invitation to invest. Please consider this as a reference and conduct thorough research before making your own decisions.

ATH after the Halving

Bitcoin halving is an event that occurs approximately every 210,000 blocks are mined, which takes roughly four years. The block reward for miners is reduced by half, leading to a decrease in the rate of new Bitcoin issuance.

This scarcity mechanism is built into Bitcoin’s protocol and contributes to its deflationary nature.

One notable observation is that after each Halving, the price of Bitcoin tends to rise and create new ATHs (All-Time Highs). This is not difficult to explain, as when miner rewards are halved, the supply of Bitcoin entering the market also significantly decreases.

From a basic supply-demand equation: when supply decreases while demand increases or remains the same, the price will rise. However, looking at the instances when Bitcoin price increased after Halving, it can be seen that it typically takes about 12 months after Halving for Bitcoin to peak.

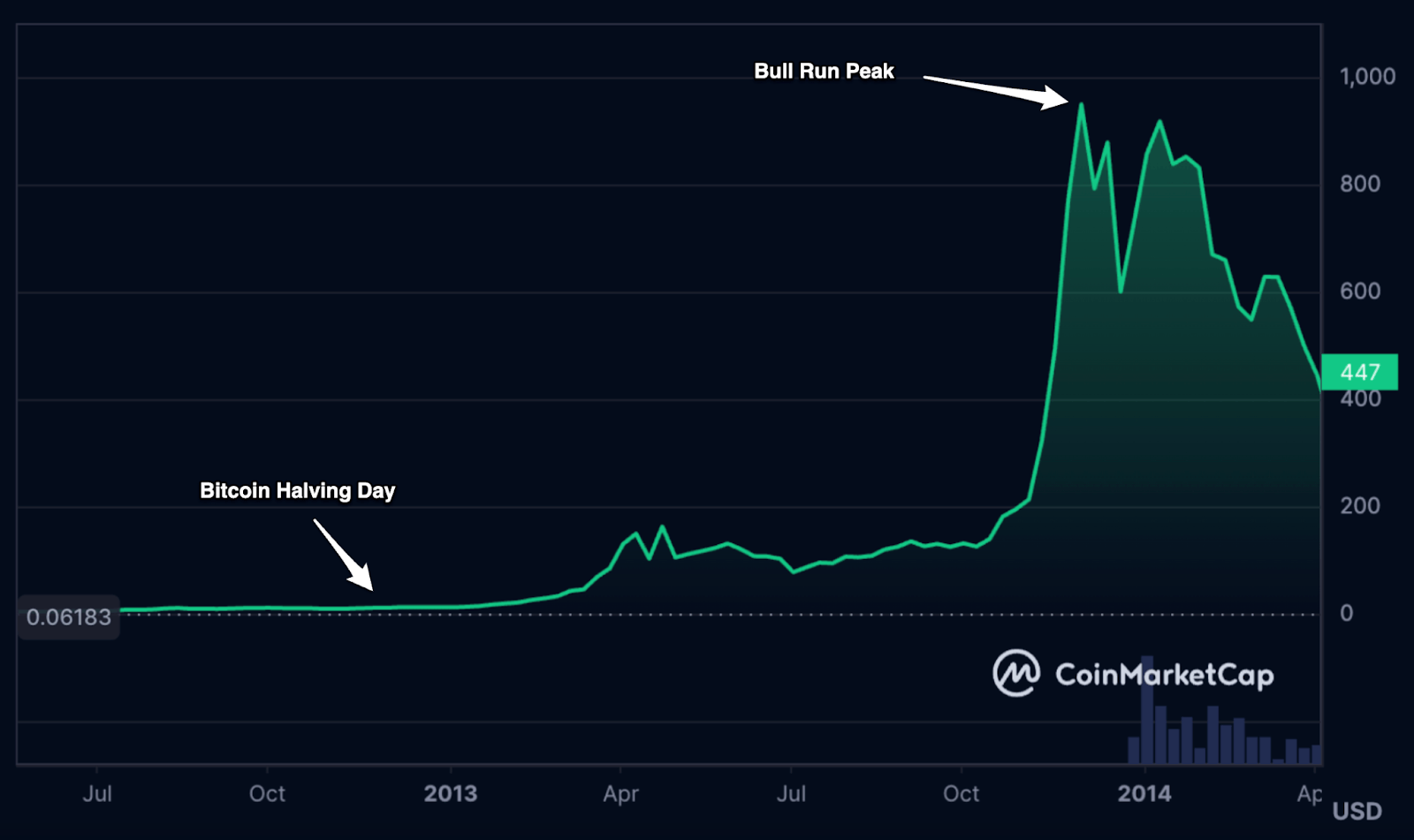

The First Halving (2012):

During this first Halving, the block reward for miners decreased from 50 BTC to 25 BTC on November 28, 2022. And then within 12 months, the price of Bitcoin increased from $12 to $1,075, leading to an 8,858% valuation increase.

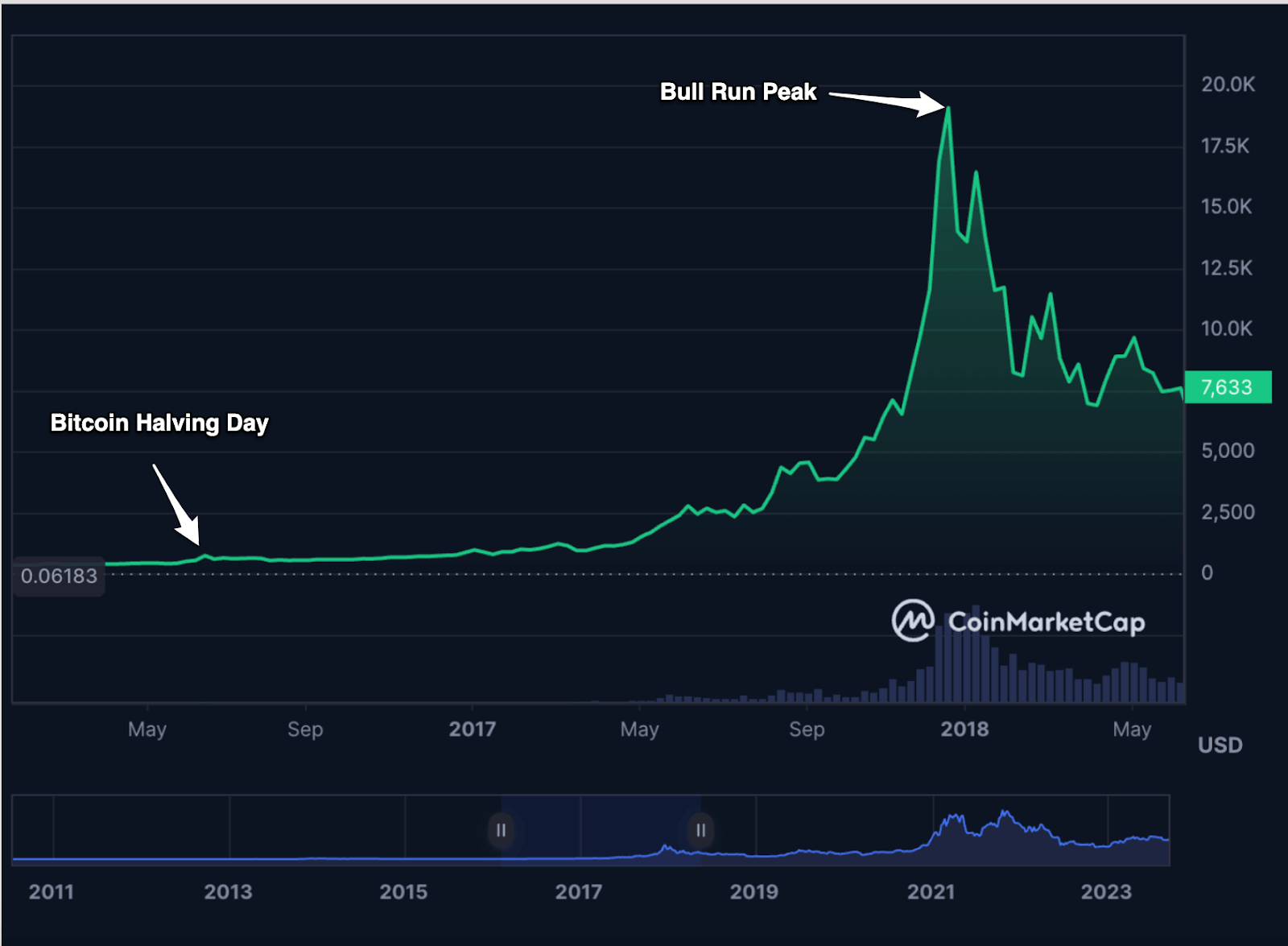

The Second Halving (2016):

The second Bitcoin halving, which occurred on June 9, 2016, reduced the mining reward from 25 BTC to 12.5 BTC. Over the following year, the price of Bitcoin climbed from roughly $650 to $2,560, marking a 294% increase in value.

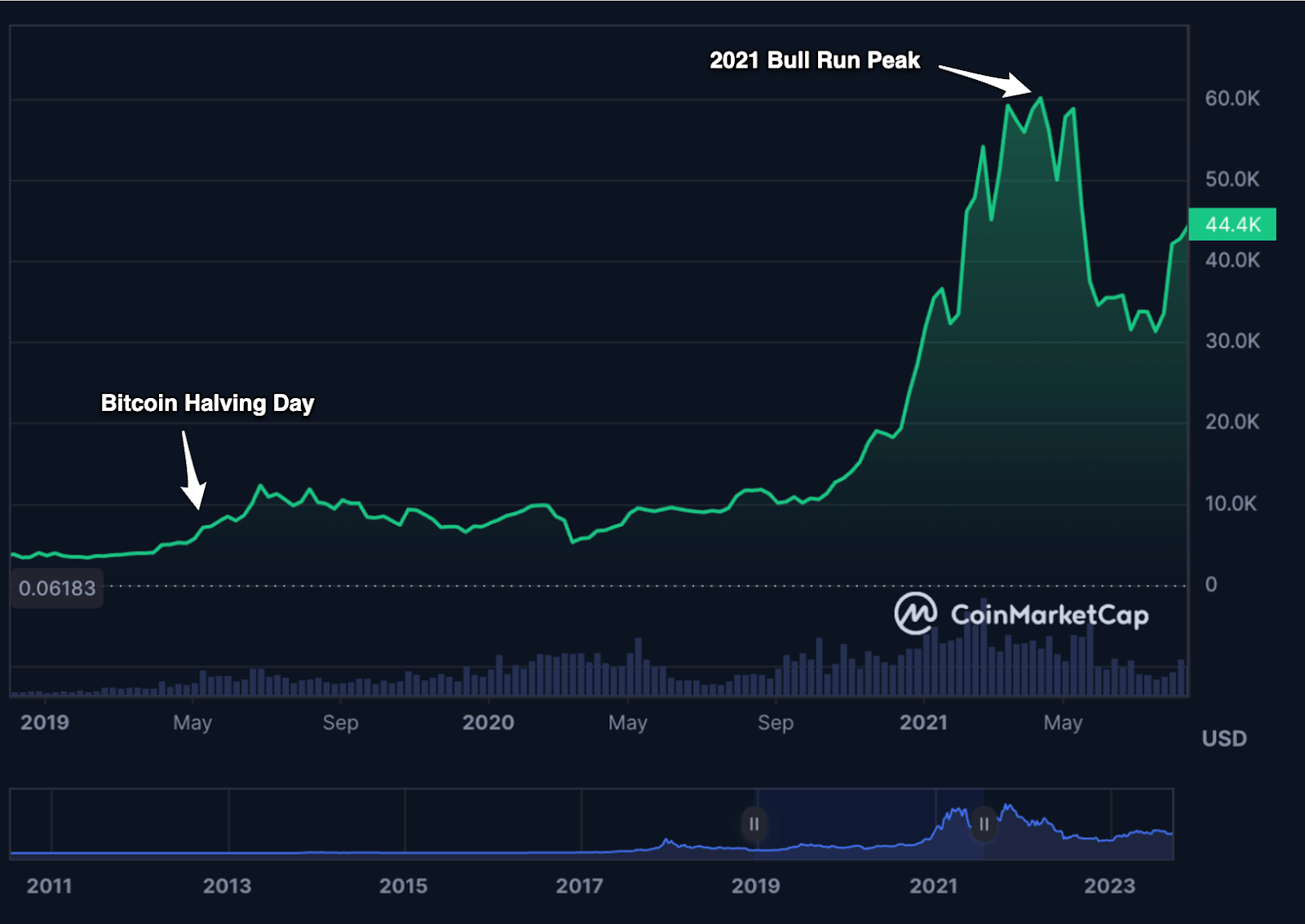

The Third Halving (2020):

Subsequently, the third halving took place on May 11, 2020, cutting the mining reward further from 12.5 BTC to 6.25 BTC. In the 12 months that ensued, Bitcoin’s price soared from about $8,727 to $55,847, yielding a 540% rise in valuation.

The Forth Halving (2024)

Looking at the charts from the previous three Bitcoin Halvings, we can observe that they share a relatively similar pattern. Approximately one year after a Halving event, Bitcoin tends to start forming a new peak. Therefore, following the fourth Halving on April 16, 2024, many are anticipating that Bitcoin will once again reach new heights.

However, this Halving differs from the previous three in a significant way. In the past, Bitcoin’s price did not exhibit major fluctuations before the Halving date. In contrast, during this fourth cycle, Bitcoin reached an all-time high (ATH) of about $73,000 approximately one month before the Halving.

Another point to note is that in the previous three Halvings, Bitcoin’s price remained relatively stable after the Halving date. This time, however, the price movements of Bitcoin seem more unpredictable.

Nonetheless, it’s important to remember that in previous Halvings, it took nearly a year for Bitcoin to reach its peak. Hence, we have a basis to expect a potential increase in Bitcoin’s price again, but all of this will take time.

Source: CoinMarketCap

Should I buy Bitcoin now?

This could be considered a million-dollar question, or perhaps even a billion-dollar one. To provide an answer, we can consider the following factors.

Please note that this is not investment advice. Here, we are merely presenting our views based on both subjective and objective analyses, as well as the current market situation. Therefore, readers should consider the following analyses as references only, and conduct thorough research before making any investment.

Supply and Demand:

This is a fundamental principle that always holds true. When supply decreases but demand increases, prices rise; conversely, when supply increases but demand decreases, prices fall.

Let’s examine the case of Bitcoin. After each Halving event, the amount of BTC awarded to miners is halved, meaning that the Bitcoin supply on the market significantly decreases. This introduces the first part of the supply and demand equation: a decrease in supply.

The next part is an increase in demand (or at least, demand not decreasing). We know that there are only 21 million Bitcoin coins available, and Bitcoin is currently the most sought-after cryptocurrency asset. Therefore, it’s safe to assert that the demand for Bitcoin is unlikely to decrease and may even continue to rise.

Thus, based on the law of supply and demand, there are several factors that support the prediction of an increase in Bitcoin’s price.

When should I buy?

Determining the optimal timing for buying Bitcoin is essential. However, based on historical data and current market trends, we believe that the price of Bitcoin will continue to rise in the future and set new records.

While we refrain from providing specific price advice due to its inherent risk, let’s explore some factors to weigh:

- Supply and Demand Dynamics:

- Bitcoin’s supply is capped at 21 million coins. As each Halving event reduces the issuance rate, scarcity increases.

- Consider the balance between the decreasing supply (due to Halvings) and the growing demand (as more people recognize Bitcoin’s value).

- Market Volatility:

- Bitcoin’s price can be highly volatile. Short-term fluctuations are common, but the long-term trend has been upward.

- Patience is essential. Avoid making impulsive decisions based on short-term price movements.

- Historical Patterns:

- Past Halvings have led to significant price increases over time.

- Observe how Bitcoin behaves after each Halving. Historical data can provide insights.

- Risk Tolerance and Investment Horizon:

- Assess your risk tolerance. Are you comfortable with Bitcoin’s price swings?

- Consider your investment horizon. Are you in it for the short term (speculation) or long term (holding)?

- Dollar-Cost Averaging (DCA):

- Instead of timing the market perfectly, consider DCA.

- Regularly invest a fixed amount (e.g., monthly) regardless of price fluctuations. Over time, this smooths out volatility.

Remember, investing in Bitcoin involves both opportunity and risk. Research thoroughly, stay informed, and make informed decisions aligned with your financial goals.

Some useful tips:

- Buy the Dip: Whenever Bitcoin experiences a price drop, consider it an opportunity to buy. The “buy the dip” strategy involves purchasing Bitcoin when its price is relatively low. However, the challenge lies in identifying whether it’s truly the bottom or if further declines are imminent.

- The Fear of Missing Out (FOMO): Many investors struggle with FOMO. They fear that if they don’t buy during a dip, they’ll miss out on potential gains when the price rebounds. Conversely, if they wait too long, they might miss the opportunity altogether.

- Averaging In: Instead of trying to time the absolute bottom, consider averaging in. Buy a portion of Bitcoin when it dips, and if it continues to drop, buy more gradually. This way, you accumulate Bitcoin at an average lower price.

- Long-Term Perspective: Bitcoin’s history shows that it tends to appreciate over time. While short-term volatility can be nerve-wracking, taking a long-term perspective helps. Patience is key, especially during market fluctuations.

Remember, investing in Bitcoin (or any asset) requires both patience and a strong mindset. Keep an eye on market trends, stay informed, and make decisions based on your risk tolerance and financial situation.

KEYRING PRO Wallet- A Professional Tool to Protect Your Assets

“Is now the right time to buy Bitcoin?” is indeed a billion-dollar question. We hope our previous analysis has helped you answer this question to some extent.

To begin investing in Bitcoin, the first thing you need is knowledge, and the second, equally crucial element is a user-friendly cryptocurrency wallet that’s not only easy to use but also packed with convenient features for managing your assets.

That’s why KEYRING PRO Wallet is the perfect choice for all crypto users. Here are some of its standout features:

- Friendly UI: KEYRING PRO Wallet boasts an extremely user-friendly interface, making it accessible for newcomers to the market as well as seasoned veterans. Owning a wallet that’s easy to navigate simplifies operations and asset management.

- Support for Major Blockchain Addresses: To best facilitate transactions in the crypto space, having wallet addresses from the top blockchains in the market is highly beneficial for asset management. Users can create addresses for major chains such as Bitcoin, Ethereum, Binance Smart Chain (BNB), Solana, Arbitrum, Optimism, Polygon, Avalanche, and more.

- Track Top Trading Coins: KEYRING PRO Wallet allows users to view the top coins across major chains. Additionally, users can search for their desired coin and exchange it directly within the app.

- Liquidity Management: In the latest 3.4.0 update, KEYRING PRO Wallet has introduced a Liquidity Management feature to make it more convenient for users to monitor their liquidity pools on Uniswap and PancakeSwap.

For a more detailed look at recent updates, please refer to the following articles: