What Does The Dollar Milkshake Theory Mean For Crypto?

What is The Dollar Milkshake Theory?

Revisiting the definition of the Dollar Milkshake Theory

Brent Johnson once argued that, before 2018, global central banks injected liquidity into the “milkshake” of the global market.

The theory, coined by Brent Johnson, the CEO of Santiago Capital, envisions a scenario where the US dollar sucks up liquidity from other currencies and countries worldwide.

Johnson unpacks a story of a massive flood of central bank liquidity and explains how capital flows are being sucked into US equity markets through the dollar.

In other words, the Dollar Milkshake Theory can be explained simply as: the dollar drinks the other currency’s milkshake, then shoots it in cold blood.

But why would the dollar suck up money from the worldwide capital market?

Isn’t that idea absolute?

Are we in a trend of de-dollarization?

Let’s first have a look at a theme that has been popping up in recent months: the trend of de-dollarization.

Related Reading: Introducing KEYRING NFT VIEWER: A Simple and Feature-Packed NFT Tool

Signs of De-Dollarization

Are countries saying goodbye to the dollar?

Some shifts are indeed happening. China and India are advancing talks to abandon the dollar for their trade. BRICS countries are developing a joint currency.

*What are BRICS Countries? They are Brazil, Russia, India, China, and South Africa. This political union represents 42% of the global population, and 26% of the global GDP, with 12 more countries applying to join. The BRICS group is expected to control a huge amount of global food, energy, manufacturing, and metal production, making it the biggest and the most important political and economic alliance on Earth.

There are some concrete examples of de-dollarization, including:

- Brazil has agreed with China to settle their mutual trade in their currencies.

- Kenya will settle the purchase of oil from Saudi Arabia in its shilling.

- Russia will use the Chinese yuan for trade with Asia, Africa, and Latin America.

- France purchased gas from China with the yuan instead of the dollar for the first time.

This is not so fast going to lead to necessary messages about the dollar.

Many countries would like to see a different balance.

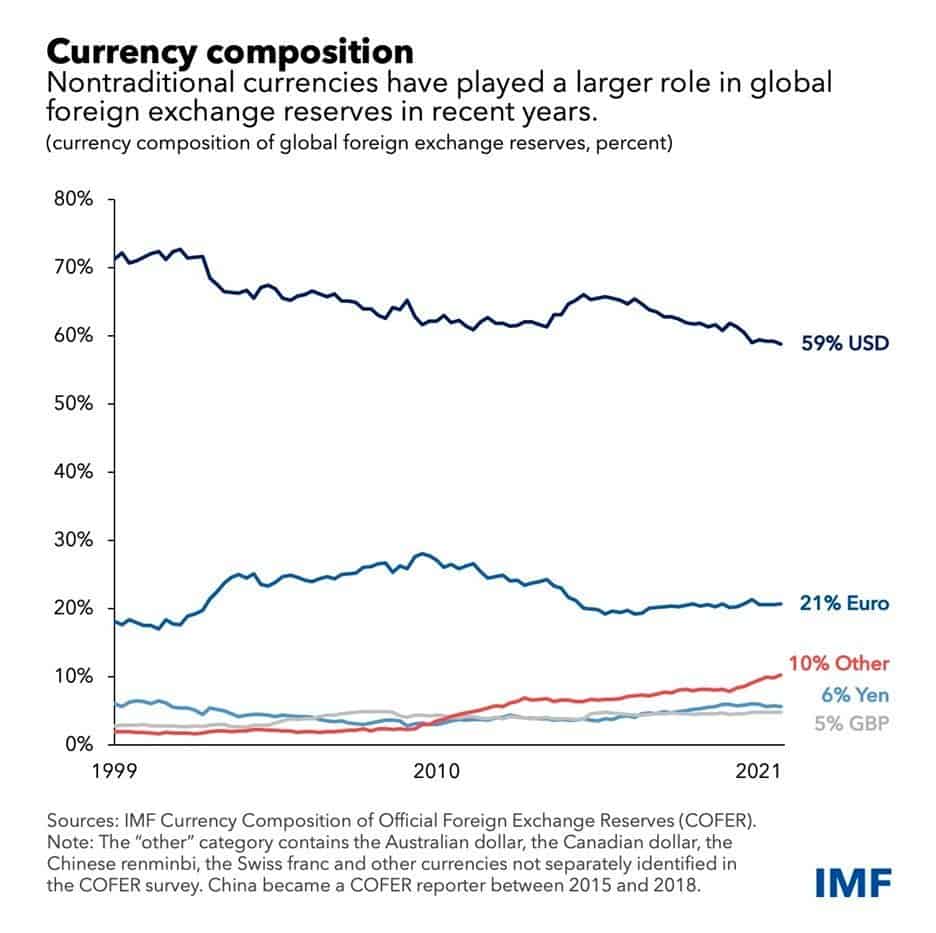

But, take a look at the IMF chart, which monitors the composition of international reserves.

These consist mainly of dollars. In other data, many debts are dominated in dollars.

Where Does The Dollar Milkshake Theory Come From?

The Dollar Milkshake Theory uses a milkshake comparison to illustrate that the dollar (and the US stock market) tend to suck up investors’ funds globally during crises.

Part of the reason is that the world is addicted to dollars even if it might want to detox.

The other reason is the flight to safety that the dollar represents.

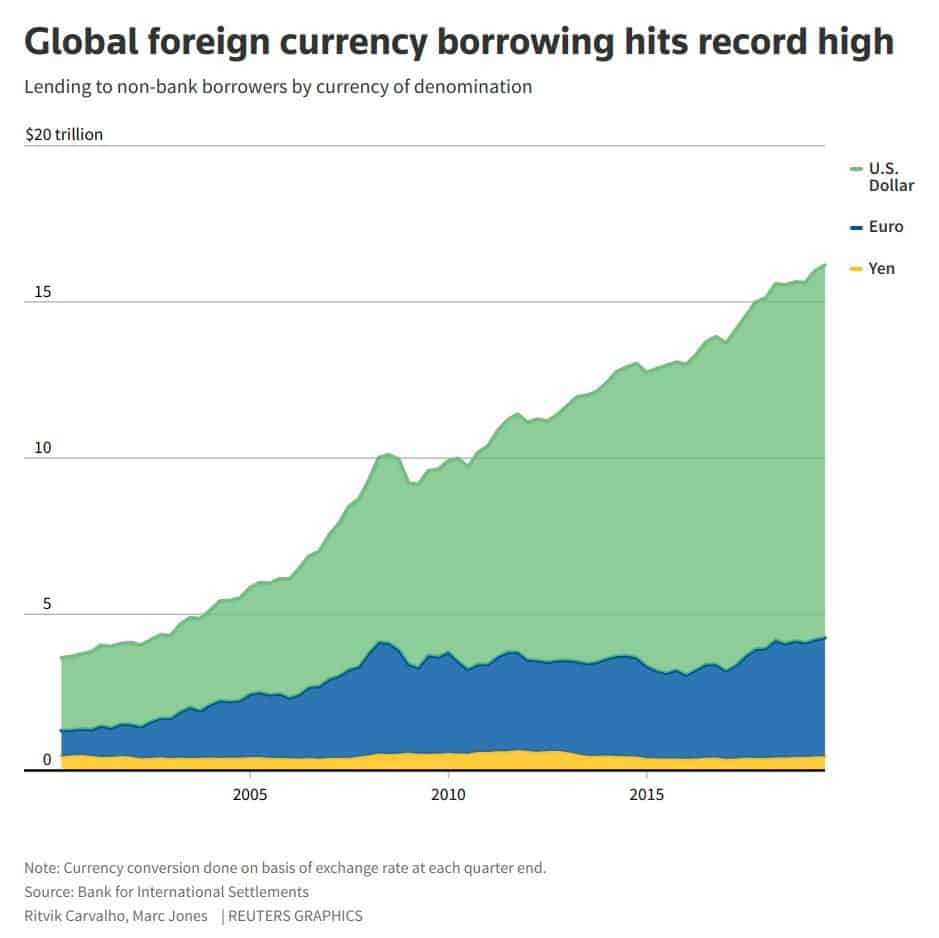

Overall, the core problem with dollar addiction is that the world needs dollars to pay off debts in dollars.

Other countries can’t print dollars so it creates extra demand. And this is where the image of the milkshake comes in.

In particular, the FED has created a big milkshake of liquidity since the global financial crisis and the pandemic.

The thing is, what would happen to this milkshake if the American Federal Reserve raised the interest rates?

Imagine if people are sucking the dollars through their straw, but they also need dollars to get some yield, and they have to pay their debt. It means they need dollars on both ends.

Even though the economies outside of the US may end up in a recession, and have less purchasing power in dollars, the dollar’s value still rises because their dollar debt burden gets bigger and bigger.

According to the Dollar Milkshake Theory, the dollar won’t be replaced because of weakness, but because of too much strength.

Related Reading: Polygon 2.0 Unveiled: A Zk-Powered Future

The Dollar Milkshake Theory is a Framework for a Sovereign Debt Crisis

What is the endgame after the dollar has killed all other currencies?

A sovereign debt crisis happens when a country’s government fails to pay its debt obligations.

This is when the authorities might step in and anchor fiat currencies such as gold or Bitcoin.

As a result, the Dollar Milkshake Theory posits that strengthening the US Dollar could be a boon for cryptocurrencies.

Related Reading: How Investors Can Tap Into Derivatives With ETFs

What Does The Dollar Milkshake Theory Imply for Crypto?

Brent Johnson has pointed out that the US government and others have tried their best to demonetize gold.

Accordingly, the Dollar Milkshake Theory brings truth to the world of currency, where the dominant currencies tend to dominate and suck out the energy from the others.

As the dollar becomes more attractive to investors, it could increase demand for alternative assets like Bitcoin, offering a hedge against inflation.

However, are there any negative impacts?

In the scenario of the sovereign debt crisis, it is predictable that investors would likely pull their liquidity from risk assets and park it into safer investments.

Related Reading: How to buy crypto with a credit card

In Conclusion

In Johnson’s vision, cryptocurrencies are nice to add to your portfolio and forget about, owning it for the endgame scenario that might be a while in the future.

The Dollar Milkshake Theory is an interesting theory to consider if you’re exploring how you could add some investment channels to your portfolio.

On the road there, sure, it’s likely that Bitcoin and other cryptocurrencies will rise, together with the dollar and US equities.

But there can also be sharp drawdowns, all you need to do is prepare for all ranges of scenarios.

Make sure to check out our article highlighting the Ethereum Triple Halving: What Investors Should Know

Comments are closed.