What is DEX ‘JUPITER’? Explaining the JLP Token

In Solana’s DEX ecosystem, JUPITER is gaining particular attention. One of the main reasons for this attention is the JLP pool and JLP token. In this article, we will provide a detailed explanation of the DEX called “JUPITER”. Please refer to it.

What is JUPITER?

JUPITER is a DEX (Decentralized Exchange) centered around the Solana network. It allows users to find the optimal route among various DEX pools for swapping. For instance, instead of using the SOL and USDC pools when exchanging USDC for SOL, JUPITER compares all available routes and suggests the most optimal one.

Additionally, it offers features like limit orders, leverage trading, and dollar-cost averaging (DCA), making it a comprehensive DEX. It is divided into five sections:

Swap

Allows swapping tokens within the Solana network. It may sometimes take a detour to find the most optimal route, even for simple swaps involving major currencies.

For example, the exchange from USDC to SOL is swapped via bSOL, as shown in the image above.

Limit Order

Enables placing limit orders. Users input the purchase price in “Buy XX at rate”. Selecting “Use Market” sets the current price. Expiry allows setting a deadline, or “Never” for a perpetual limit.

DCA (Dollar-Cost Averaging)

Sets up recurring token purchases. Users select the token they want to exchange from “I want to allocate”, the token they want to buy from “To buy”, set the frequency from “Every” (daily, hourly, etc.), and the duration from “Over”.

Bridge

Facilitates token exchanges across networks. It allows exchanging tokens between Solana and other networks. JUPITER can connect to the Ethereum-based No.1 wallet Metamask, making transitioning to the Solana network easy.

Perpetual (Beta)

Offers leverage trading with up to 100x leverage and provides JLP tokens, which are SPL tokens, through the JLP pool.

What is JLP token (JLP Pool)?

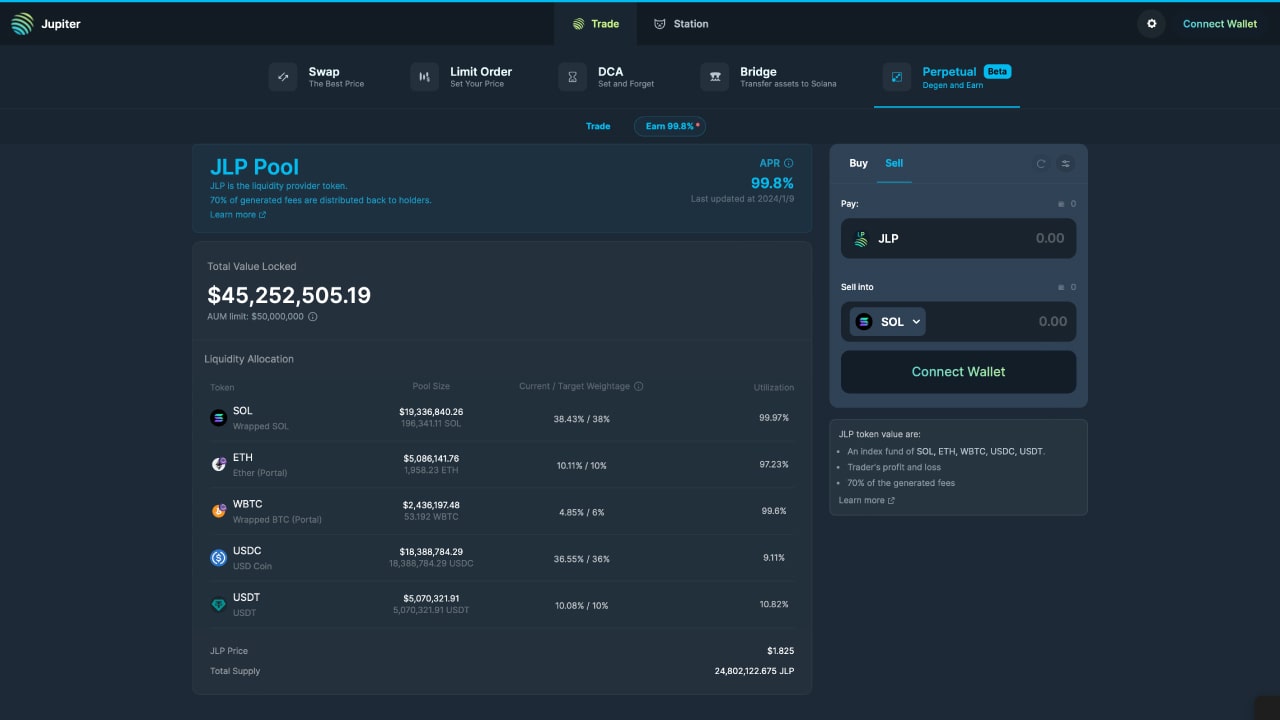

Users can obtain JLP (Jupiter Perps) tokens by allocating assets or tokens to the JLP pool. The JLP pool is allocated to SOL, ETH, WBTC, USDC, and USDT. It receives 70% of the fees, designed for swap and leverage trading, which are reinvested directly into the pool, generating compound interest. An increase in the price of the underlying assets (SOL, ETH, WBTC, USDC, USDT) means an increase in the JLP token price.

When traders want to open leverage positions, they borrow tokens from the pool. Liquidity providers earn fees from such leverage trades, as well as revenue from borrowing fees and swaps.

Currently, the JLP pool has reached its $50 million limit and is not accepting new funds. To participate in the pool, one must either purchase JLP tokens directly or wait for a change in the limit.

Summary

While DEXs are often associated with simple swap interfaces, developments like JUPITER with added features such as leverage trading are emerging. Despite being decentralized, some DEXs are becoming indistinguishable from centralized exchanges (CEXs).

We hope this article proves helpful.