MEV-Burn Proposal: ETH even Scarcer

Since the cryptocurrency space is constantly evolving, new proposals may emerge.

Because of mempool-related arbitrage, Ethereum developers have recently proposed a rigorous solution for the battles that have been broken down from time to time.

And what is the solution they could use? They will burn the ETH that MEV traders currently pocket!

This proposal may have both pros and cons.

While the primary goal is to solve part of Ethereum’s stability, the not unwelcome byproduct is that Ethereum will become more scarce, or even deflationary.

So what is MEV?

Let’s find out more in the following sections of this article.

What is MEV?

MEV stands for Maximal Extractable Value, meaning the additional profit validators can scoop up while adding blocks to the blockchain.

This definition arises as a function of the overlapping preferences of market participants who transact on a blockchain.

MEV originally meant Miner Extractable Value, the term has since evolved to mean Maximal Extractable Value.

In order words, MEV is a value captured on a chain in a game that is played between miners, researchers, block builders, wallets, and users.

Historically, mining pools have sat in the privileged position of being able to select which transacts are or are not included in a block.

MEV provides an opportunity for any on-chain actors to extract value, but those opportunities are not distributed uniformly within blocks. They can be unpredictable and highly lucrative.

Its supply chain process will be explained in the picture below before we get to gain a better sense of the concepts of MEV.

- The user who has the intent to transact logs into their web3 mobile or browser wallet which is used to connect to the decentralized application’s front end

- Wallet signs the user’s transaction, interacts with the Web3 API, then sends the user transaction to a local node. Some wallets rely on a Node service provider like Infura

- The Local Node receives the signed transaction and validates its correctness before propagating it to Peer Nodes

- Full Nodes gossip the pending tx and store it in their general memory or “mempool”

- Mining pools pick up transactions from the Memory Pool and order those by a greedy algorithm that sequences tx based on fees. The limit per block is 30M gas. The target block size is 15M

- The mining pools create a block template and forward the headers to miners who compete to solve the difficult puzzle, eventually giving the winning block weight in the fork choice rule

- Once a valid block is mined the miner will inform the network and the block will be broadcasted to and propagated by the full nodes who check that all of the block’s transactions are valid; full nodes can reject invalid blocks that do not follow consensus rules.

Types of MEV

There are four general types of MEV:

- Arbitrage

- Liquidations

- Sandwich (front/back run)

- Long-tail

Arbitrage

Arbitrage plays an important role on-chain as Decentralized Exchanges (DEX) rely on arbitragers to keep the prices of their Automated Market Makers (AMM) in line with competing AMMs and off-chain oracle prices.

A common arbitrage opportunity occurs when AMMs contain the same toke pairs, e.g., ETH-DAI, across different DEXs are imbalanced.

Another example is off-chain to on-chain, e.g., centralized exchange to a decentralized exchange (DEX).

Liquidations

Liquidations occur when a debt position on-chain becomes undercollateralized.

Typically, users who seek liquidity for their on-chain assets can post them as collateral in order to take out a loan.

Because liquidations can be quite profitable, there is much competition among searchers to capture this form of MEV.

Liquidations can be extremely lucrative and represent some of the best MEV opportunities.

Sandwiches

Sandwiches are probably the most well-known form of MEV as they are user-facing, namely the most toxic one.

Sandwiches are probably the most well-known form of MEV as they are user-facing, namely the most toxic one.

At its core, a sandwich attack is a form of front-running that primarily targets DeFi protocols.

Specifically, in a sandwich attack, a trader looks for a pending transaction on a chain of their choice, then front-run and back-run simultaneously, with the original pending transaction sandwiched in between.

A sandwich occurs when a user sends a swap transaction to the general memory pool with a non-0 slippage.

The purpose of this whole thing is to manipulate asset prices.

Participants of Ethereum’s public memory pool are able to maximize the money they make from block creation by reordering transactions within blocks and even inserting new ones.

The majority of this type of attack will be performed through automated market makers (AMMs), such as Uniswap, Pancakeswap, Sushiswap, etc.

Even though they are not as popular an attack as rug pull, sandwich attacks can cause pretty much problems in DeFi, to the extent that Ethereum’s founder once warned us about them back in 2018.

It is crucial to protect users from sandwich attacks by developing countermeasures.

For example, 1inch introduced a new order type called “flashbot transactions”, which is not visible in the memory pool. At the same time, they will directly connect with trustworthy miners to make transactions visible after they are mined.

Long-tail

Long-tail MEV activities denote uncommon or infrequent types of MEV not mentioned above.

It can be the most profitable.

It is captured by interacting with lesser-known protocols.

MEV-Boost

MEV-Boost is an implementation of Proposer Builder Separation (PBS) provided by Flashbots developed in collaboration with Ethereum developers and researchers.

Validators are going to maximize their staking reward by using this method and selling block space to an open market of builders.

How Can You Burn MEV?

First, quantifying the amount of MEV. The simplest way to do this is using a Proposer/Builder Separation (PBS).

In PBS, builders compete against each other and offer bribes to proposers for their blocks to be included. Then proposers just simply have to pick the top bid.

Nowadays, such auctions happen out of the protocols via MEV-Boost.

Want to burn MEV directly in the protocol? The first, and probably the hardest step, is to enshrine PBS.

This way has multiple benefits, but the most relevant one would be the protocol itself will become aware of MEV bids.

A less direct alternative way to burn MEV would be to combine two distinct proposals. Specifically, smoothing it across validators, then adjusting the yield curve. That way MEV would go to validators, but they would be paying for their spot.

Does MEV-Burn Solve Toxic MEV?

The answer is no.

MEV-Burn will not eliminate toxic MEV.

What are the Benefits of MEV Burn?

Burning MEV solves a few problems, including:

- Smoothing the staking yield

- More stable validator set

- Reducing incentive to reorg the chain

- Enhancing the economic qualities of ETH

Does ETH Get Even Scarcer?

The prediction is impossible, but you can look at the MEV-Burn Proposal dashboard, particularly the amount of MEV going to proposers.

As of early May 2023, it is estimated that burning MEV would have resulted in supply declining roughly 3 times faster.

A Problem with MEV

MEV is a small industry. Currently, hundreds of thousands of dollars per day are squeezed from blockchain transactions by MEV bots.

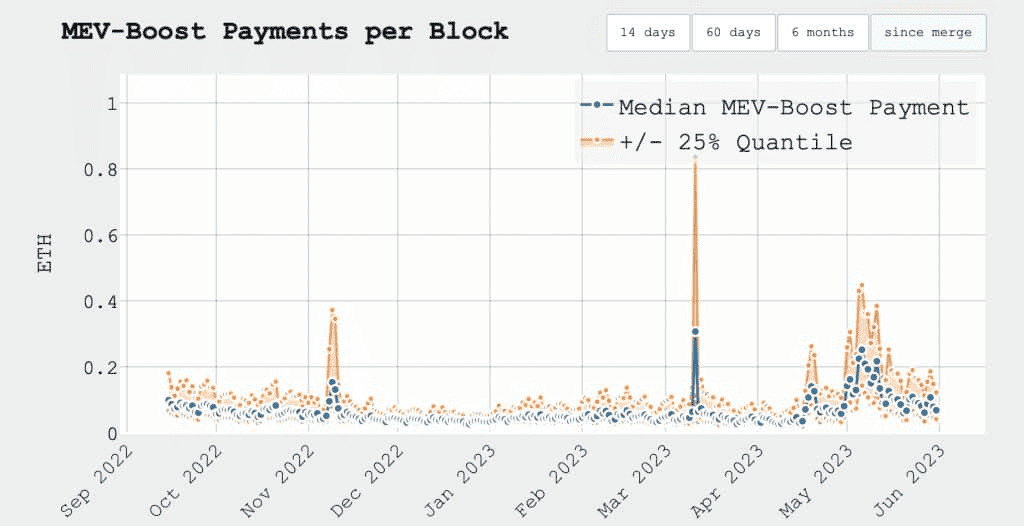

As you can see, the average MEV payment is around 0.05 ETH per block.

But it can spike dramatically to an insane 1 ETH per block, happening for a couple of hours.

Within those couple of hours, there have been blocks in that a lucky validator squeezes more than 100 ETH from a single block.

These spikes usually occur when a new token or NFT of a popular public project launches. At such times of high traffic and congestion, validators can benefit from their “inside knowledge” and front-run others’ transactions.

MEV-Boost still leaves room for those undesirable spikes. Therefore, MEV-Burn will have to get rid of those.

So When is MEV-Burn?

It will likely take four years or so to be implemented.

Because the Proposer-Builder Separation (PBS) needs to be implemented first. This is scheduled to go live in the splurge phase of the Ethereum roadmap.

In the meantime, MEV bots can enjoy those sweet profits.

Summary

Ultimately, MEV will exist in some form. This is assumed as the biggest upgrade of Ethereum since EIP-1559.

While the market is still evolving in the infrastructure and the application of layers, acknowledging MEV now is critical.

Composable blockchains that prioritize mitigating the negative effects of MEV will reduce the existential risk for their own chains. And within public blockchains that are censorship-resistant, mass adoption can be much safer.

This article explained what MEV is, how the blockchain space and market take advantage of MEV-Burn, and how we can avoid some possible negative effects.