What Is Solana? And Why You Can’t Afford to Ignore It

Lately, Solana has emerged as one of the most powerful layer-1 blockchains in the world — fast, cheap, and increasingly popular. But how many people truly understand what is Solana, and why it’s able to deliver such performance?

In this blog, we break it all down.

Why the World Needed Solana

Before Solana, the blockchain space was struggling to keep up with its own ambition. Ethereum led the way in smart contracts and decentralization, but its limitations were clear: high gas fees, slow transaction speeds, and constant congestion. Web3 promised a future of open access and seamless interaction — but in practice, it felt more like waiting in line at a broken ATM.

Solana emerged with a bold answer: a high-performance blockchain capable of tens of thousands of transactions per second, low fees, and no need for complex scaling solutions. Not just a patch on existing tech — but a clean-slate approach, designed for speed and scale from the ground up.

It didn’t set out to replace Ethereum, but to prove that Web3 could perform like Web2 without sacrificing decentralization. In a space where delays and workarounds were the norm, Solana showed what was possible when performance was the priority.

What Is Solana?

Solana is a high-performance, layer-1 blockchain designed to deliver speed, scalability, and extremely low transaction costs — all while maintaining decentralization.

But what truly makes it different isn’t just what it achieves, but how it does it.

Breaking Away from Traditional Consensus Models

Most blockchains today rely on well-known consensus mechanisms: Proof of Work (PoW) and Proof of Stake (PoS).

Solana takes a different approach. It introduces a new architecture centered around:

- Proof of History (PoH) — a cryptographic timekeeping system

- A fast, stake-based validator model powered by Proof of Stake

- A series of technical innovations that improve every layer of the network

Proof of History (PoH): Time as a Core Component

PoH is not a consensus mechanism itself. It’s a decentralized clock that allows every node in the network to agree on the order of transactions — without having to communicate or wait for one another.

Here’s how it works:

- Solana continuously generates a chain of SHA-256 hashes.

- Each hash depends on the previous one, forming a verifiable, time-ordered sequence of events.

- Transactions and events are inserted into this chain, effectively “timestamping” them.

This makes transaction ordering deterministic, removing one of the biggest bottlenecks in traditional blockchains. Validators can now process transactions independently and with confidence in their ordering, which leads to much faster consensus.

Proof of Stake (PoS): Securing the Network

While PoH handles the timing and ordering of events, Solana uses a modified Proof of Stake model to secure the network and finalize blocks.

- Validators stake SOL (the native token) to participate in block production.

- For each time slot, one validator is chosen as the leader, based on stake weight and performance.

- That leader uses the PoH ledger to sequence transactions and propose a block.

- Other validators vote on the proposed block’s validity using a consensus mechanism called Tower BFT.

This combination of PoH and PoS provides both speed and security:

- PoH solves the “when” and “in what order”

- PoS (via Tower BFT) ensures agreement and resistance to attacks

Solana’s Additional Performance Modules

Beyond PoH and PoS, Solana includes several key innovations designed to eliminate friction and increase throughput:

- Turbine: A block propagation protocol that splits data into small packets, similar to BitTorrent, for fast and efficient distribution across the network.

- Sealevel: A parallel smart contract engine that can process thousands of contracts at the same time, unlike Ethereum’s single-threaded EVM.

- Gulf Stream: A system that forwards transactions to upcoming leaders even before they’re confirmed — removing the need for a mempool.

- Tower BFT: An optimized version of Practical Byzantine Fault Tolerance (PBFT), designed to work efficiently with PoH and provide fast finality even if up to 1/3 of nodes fail or act maliciously.

The Result: Speed and Scale Without Sacrifice

- Transactions are confirmed in milliseconds

- Fees remain under a penny

- No need for sharding or rollups

- They delivers raw performance at the base layer, while staying decentralized

Solana ETF: Everything You Need to Know and Why It Matters – KEYRING PRO

Developer-Ready and Mass-Adoption Friendly

Solana supports smart contract development in Rust, C, and C++, giving developers access to low-level performance and efficiency.

With tools like Anchor, the Solana CLI, and various SDKs, building dApps on Solana is faster and more accessible than ever.

For end users, the experience feels like using a Web2 app — fast, smooth, and responsive — but built entirely on Web3 infrastructure.

The Vision: What Solana Set Out to Do

Solana’s mission is to build a high-performance, decentralized blockchain that can scale to meet global demand — without compromising on speed, security, or decentralization.

Most blockchains struggle with the “Blockchain Trilemma”, where improving scalability often weakens either security or decentralization. They takes a different approach by redesigning the core architecture from the ground up.

Its goal is simple: Enable fast, low-cost, and secure blockchain applications that feel as smooth as Web2 — but run on Web3 infrastructure.

To achieve this, they combine:

- Proof of History (PoH): A cryptographic clock that orders transactions without needing global coordination.

- Proof of Stake (PoS) + Tower BFT: A fast and secure consensus mechanism for finalizing blocks.

- Developer-friendly tools and low-level languages (Rust, C, C++) to make building powerful dApps accessible.

The result? A blockchain that settles transactions in milliseconds, costs fractions of a cent, and scales without needing sharding or rollups.

From Paper to Power: What Solana Has Achieved So Far

What They Have Achieved So Far

What draws attention and users to Solana is that it delivers on what it promises. They set clear goals and actively work toward them—let’s take a look at what they’ve achieved so far.

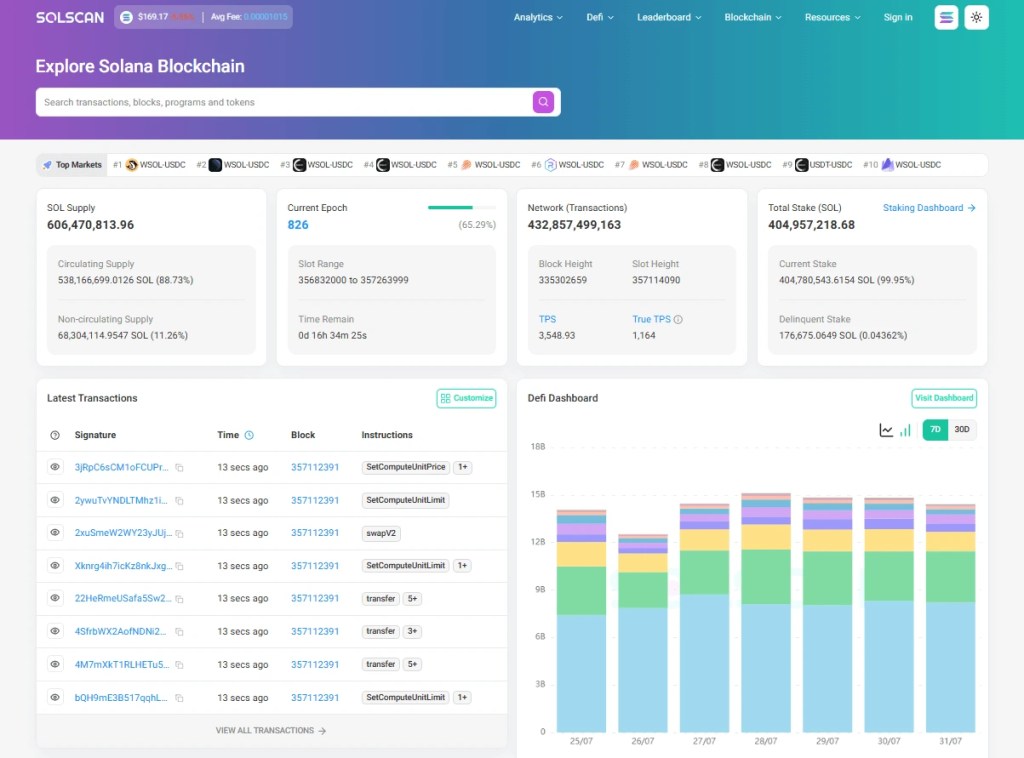

- High Scalability: The Network averages 65,000 TPS with peaks of 138 million daily transactions, and Firedancer reached 1 million TPS in tests—still short of the 710,000 TPS goal, but momentum and upcoming upgrades suggest it’s within reach.

- Low Transaction Costs: Solana keeps fees low ($0.00025–$0.02) while handling massive volumes, generating $260M in 2024 without raising costs—firmly meeting its goal, with growing real-world adoption through Solana Pay and Visa integrations. Driven by a significant surge in demand, PayPal and Venmo have integrated Solana into their payment infrastructure.

- High-Speed Transactions: With block finality around 8 seconds and plans for 100ms, they delivers fast confirmations through PoH and PoS, achieving its speed target and continuing to accelerate with upgrades like Firedancer and Helix.

- Support for Decentralized Apps: Solana has built a thriving dApp ecosystem across DeFi, NFTs, and gaming, with $9.5B TVL and 120M daily active addresses—meeting its goal and expanding further into AI, RWAs, and mobile Web3.

- Decentralization and Security: Solana operates with over 2,300 validators and improved stability, but past outages and security incidents mean full decentralization and security are still in progress—though new tools like SAS and encrypted mempools show strong improvements.

- Energy Efficiency: Solana’s PoS and PoH model uses very little energy, easily achieving its sustainability goal and gaining traction with developers building climate-conscious applications.

- Global Financial Infrastructure: With a $95B market cap and integrations across payments and tokenized assets, Solana is on its way to becoming a global financial platform, though full realization will depend on continued institutional adoption and regulatory clarity.

Why PayPal and Venmo Added Chainlink and Solana to Their Platforms? – KEYRING PRO

Why Solana Is Exploding Right Now

Solana’s rapid growth in 2025 is driven by major technical milestones, institutional partnerships, ecosystem expansion, and shifting market dynamics. Despite price volatility, it continues to advance toward — and beyond — its original goals.

Technical Milestones

- Firedancer achieved 1M TPS in testing; Q4 update targets 100ms finality.

- Block Assembly Marketplace (BAM) and encrypted mempools improve performance and security.

- Blockspace expansion and consistent 100% uptime strengthen scalability and reliability.

Institutional Adoption

- Citibank, Visa, Shopify, Google Cloud integrate Solana for payments, gaming, and finance.

- Over $293M in tokenized assets issued via partners like BlackRock and VanEck.

- ETF proposals from VanEck, Bitwise, and Grayscale reflect growing confidence.

Ecosystem Growth

- Leading in DeFi with $188B DEX volume and $9.5B TVL.

- Retail activity fueled by memecoins (e.g., BONK, PENGU) and NFT momentum.

- New sectors emerging: AI, mobile Web3, and developer tooling (e.g., Realms v2, Metaplex).

Market and Policy Tailwinds

- Benefiting from an altcoin rally and increased institutional interest.

- Positive regulatory signals (GENIUS Act, Trump crypto stance) support future growth.

- Strong validator incentives and Nakamoto Coefficient of 20 uphold decentralization.

Challenges

Despite its momentum, Solana still faces real challenges — some technical, some reputational, and others rooted in market dynamics.

Price Volatility and Token Unlocks

- SOL dropped ~60% from its January 2025 high ($293 → $181) due to large token unlocks tied to the FTX bankruptcy (11.2M SOL on March 1, plus smaller releases in April and May).

- This supply pressure, combined with profit-taking after memecoin rallies, contributes to ongoing volatility.

Memecoin-Driven Scams and Hacks

- While memecoins brought attention and liquidity, they’ve also invited rug pulls and fraudulent projects — like LIBRA, which collapsed from $4.6B to $100M.

- The Bybit hack, involving Solana-based memecoins to launder $1.4B, has further eroded trust among some users and institutions.

Network Congestion

- During peak activity — especially during meme frenzy — network congestion returns.

- Transaction failures, delays, and fee spikes frustrate both users and developers.

- Projects like Solaxy (a Solana-based Layer-2) are being developed to handle overflow, but the base layer still gets saturated under extreme load.

Security and Historical Reliability

- Solana hasn’t had an outage since Feb 2023, but past incidents still haunt its reputation.

- While uptime is now solid, confidence takes time to rebuild — especially for institutions managing real capital.

Regulatory Uncertainty

- The SEC lawsuit in 2023 labeled SOL as a security. Though the token has since been relisted on major platforms (e.g., Robinhood), the regulatory cloud hasn’t fully cleared.

- Even with Trump’s crypto-friendly posture, Solana still needs long-term clarity — especially if ETFs are to be approved.

Centralization Concerns

- The Nakamoto Coefficient dropped from 1,900 to 1,295 consensus nodes, raising questions about validator diversity.

- Though still leading in decentralization metrics, maintaining a healthy validator set is key as network demands grow.

What’s Next for Solana?

Network Upgrades

- Firedancer Validator (Q4 2025): A new independent client by Jump Crypto to boost throughput past 1 million TPS and enhance network resilience.

- Accounts Lattice Optimization (SIMD-215): Reduces computational load for account updates, improving efficiency.

- Block Capacity Expansion: Compute units per block increased from 48M to 60M to support higher transaction volume.

- Block Assembly Marketplace (BAM): Modular block production system enabling greater transaction transparency and DeFi flexibility.

Internet Capital Markets Vision (By 2027)

- Multiple Concurrent Leaders (MCL): Allows parallel transaction processing for faster global price discovery.

- Application-Controlled Execution (Exploratory): Research into app-defined transaction ordering for improved market integrity.

Ecosystem Growth

- Cross-Chain via Wormhole: Asset transfers between Solana, Ethereum, and other chains through Wormhole bridge.

- DeFi Expansion: Leading DEX volume with protocols like Jupiter, Orca, and Solend.

- NFT Momentum: Continued growth led by platforms like Magic Eden and Tensor.

Institutional & Community Engagement

- Institutional Adoption: Projects from Franklin Templeton and Société Générale leverage Solana for tokenized assets.

- ETF Speculation: Growing interest in a potential Solana ETF amid rising institutional demand.

- 2025 Events:

- Solana Crossroads (Istanbul, April)

- APEX (Mexico City, Singapore, etc.)

- Breakpoint (Abu Dhabi, December)

Governance & Sustainability

- Decentralized Governance: Ongoing work to strengthen community participation in protocol development.

- Environmental Impact: Energy-efficient design aligns with ESG standards, far outperforming Bitcoin and Ethereum.

Final Thoughts: Should You Pay Attention?

Solana is no longer just a fast blockchain — it’s becoming a full-stack platform powering finance, gaming, AI, and real-world assets. With strong backing from major institutions and consistent technical progress, it’s building toward a future of high-speed, open markets that run 24/7. If you’re looking for a network that combines performance, innovation, and growing real-world use, Solana is definitely worth paying attention to.

KEYRING PRO Wallet – The Power of Multichains

In today’s rapidly growing and interconnected blockchain landscape, chains are constantly working to improve cross-chain compatibility and attract more DApps. In this environment, having a multi-chain, multi-purpose wallet isn’t just convenient — it’s essential.

KEYRING PRO Wallet is the perfect choice for that.

KEYRING PRO is a multi-chain wallet that allows users to create wallet addresses across different blockchains quickly and easily. It supports a wide range of networks, and also lets users add custom chains — giving them the freedom to connect to virtually any chain they want. This means seamless cross-chain interaction and easy access to DApps across ecosystems.

What truly sets KEYRING PRO apart is how closely it listens to its users. Feedback is taken seriously, bugs are fixed fast, and useful new features are added regularly. In its latest update, KEYRING PRO introduced Gas Fee Sponsorship, allowing users to make transactions without needing the native token to cover gas fees.

On top of that, KEYRING is building a full ecosystem of connected apps — from hot wallets and cold wallets, to NFT management and even an email-based wallet.

Download KEYRING PRO Wallet today and experience the powerful tools it brings to your Web3 journey.