What Is RXS Crypto? What Happened to Rexas Finance?

Rexas Finance (RXS) burst onto the crypto scene with promises to reshape how people invest in real-world assets (RWAs). By combining the liquidity of blockchain with traditionally illiquid assets like real estate, art, and commodities, the project quickly captured investor attention.

Its massive presale and explosive early listings generated enormous hype, positioning Rexas as a potential “game-changer” in the sector. Yet, only weeks later, RXS has suffered a dramatic crash, leaving many investors wondering what went wrong.

What Are Rexas Finance and RXS Crypto?

At its core, Rexas Finance is a blockchain-based platform designed to democratize ownership of real-world assets. Through tokenization, it allows fractional ownership of assets that are normally out of reach for most investors—property, fine art, intellectual property, and more.

The platform was built on Ethereum but engineered for cross-chain compatibility, offering tools like the Rexas Token Builder and QuickMint Bot to make token creation simple, even for non-technical users. Additional features included a launchpad for fundraising, staking opportunities for token holders, and AI-powered systems for risk management and compliance.

Crucially, Rexas also emphasized regulatory awareness, positioning itself as a bridge between traditional finance (TradFi) and decentralized finance (DeFi).

The vision was bold: to create a secure, compliant ecosystem where anyone could access investment opportunities once reserved for institutions and the ultra-wealthy.

Why Did Rexas Finance Become So Popular?

The excitement surrounding Rexas Finance was fueled by several powerful drivers. The most visible was its presale, which ran from September 2024 to June 2025 and raised more than $55.6 million. Nearly 500 million tokens were sold at $0.20 each, signaling strong investor demand long before the product was live.

Momentum grew when RXS was listed on major centralized exchanges—MEXC, BitMart, and LBank—on June 19, 2025. Within a single day, the token surged by 300%, briefly pushing its market capitalization to over $74 billion. Media outlets quickly picked up on the story, while traders poured in, hoping to ride the wave.

Beyond the financial headlines, the project’s focus on tokenizing RWAs tapped into one of the most talked-about trends in Web3. Analysts projected the sector could reach $5.6 billion by 2026, and Rexas seemed well-positioned to seize the opportunity.

Adding fuel to the hype was the Rexas Millionaire Giveaway campaign. The project announced a $1,000,000 prize pool, split among 20 winners who could each claim $50,000 USDT. To qualify, participants needed to contribute at least $100 to the presale and complete referral-based quests, effectively turning early adopters into promoters.

This strategy not only boosted presale participation but also drove a surge in search interest and social media chatter, amplifying Rexas’s visibility across the crypto space.

Comparisons to Solana and Ripple further stoked speculation, with some even dubbing it a “Solana Killer.” Aggressive community campaigns, giveaways worth millions, and a CertiK audit added to its credibility. For a brief moment, Rexas looked like one of the hottest projects in crypto.

Why Did the Price Collapse?

The downfall of RXS was as sharp as its rise, and several factors converged to bring about its decline.

First, expectations around the token’s launch price proved disastrous. Investors were led to believe RXS would debut at $0.25, but the actual listing came in far lower—up to 60% below that figure. This gap triggered immediate sell-offs and crushed confidence almost overnight.

Second, questions about transparency began to surface. While Rexas promoted its presale numbers heavily, the whitepaper offered little in terms of a concrete roadmap. The development team remained largely anonymous, and technical progress updates were minimal. Communities on Reddit and Telegram voiced growing frustration, accusing the project of prioritizing hype over delivery.

Third, the competitive and uncertain landscape of RWA tokenization made matters worse. Projects like Bitcoin Hyper were gaining momentum, while regulatory hurdles remained significant. Even with strong funding, integrating real-world assets into DeFi is a daunting task—and Rexas had yet to demonstrate it could overcome those challenges.

Finally, the massive surge after listing was driven by speculative trading rather than genuine utility. With no beta product available and no clear timeline for when features would launch, the token’s price was inflated by hype. Once early investors began cashing out, the correction was inevitable, and without strong fundamentals to support the price, RXS tumbled.

Current Status of RXS

As of August 18, 2025, RXS trades at about $0.003989, down over 90% from its all-time high of $0.1147 just two months earlier. Daily trading volume sits around $176,000, a far cry from the frenzy of June. The token hit its all-time low of $0.00301 on August 2, showing only a slight recovery since then.

Looking forward, forecasts remain divided. Some analysts expect the token to hover in the range of $0.0065 to $0.015 for the rest of 2025, with more bullish voices speculating wildly about values as high as $1 to $2.50.

In 2026, predictions narrow to between $0.008 and $0.025, while longer-term estimates for 2030 suggest an average of $0.065, with an optimistic ceiling of $0.11. But all of these numbers depend on Rexas delivering real products, overcoming transparency concerns, and surviving in a competitive market.

Is Rexas Finance a Scam? Signs Point That Way

Based on what’s available, Rexas Finance (RXS) raises so many red flags that calling it a scam isn’t far-fetched—though there’s still no “smoking gun” proof. Here are the main signals that worry investors:

Red Flags That Can’t Be Ignored

- No Regulation: Rexas isn’t licensed by authorities like the FCA, ASIC, or CySEC. With zero oversight, there’s no safety net if things go wrong.

- Too-Good-To-Be-True Promises: The project dangled high returns with little to no risk—classic bait in many crypto scams.

- Shady Transparency: The team stays anonymous, the roadmap is vague, and technical details are thin. That alone is a huge trust killer.

- Presale vs. Listing Trap: Tokens sold at $0.15–$0.20 during presale cratered to fractions of a cent post-listing. Many investors call it a pump-and-dump in disguise.

- Withdrawal Headaches: Complaints of frozen funds, hidden fees, or radio silence from support echo patterns seen in fraudulent platforms.

- Aggressive Hype Machine: From million-dollar giveaways to alleged fake endorsements, Rexas leaned heavily on pressure tactics rather than product delivery.

- Copy-Paste DNA: The project’s playbook resembles other suspected scams like Retik and Renq Finance—same look, same marketing, same presale schemes.

- Community Backlash: On Trustpilot, Reddit, and Telegram, users describe it as a rug pull, citing massive losses and broken promises.

- Suspicious Tokenomics: A heavy tilt of supply towards insiders and presale whales means retail investors were always at risk of being dumped on.

Arguments That Suggest Legitimacy

- Successful Presale: Raising $55.6 million is no small feat, and a CertiK audit does lend some credibility (though audits only check code, not intentions).

- Exchange Listings: Getting on MEXC, BitMart, and LBank gives a surface layer of legitimacy, but listings are far from bulletproof—exchanges have listed plenty of shady tokens before.

- Attractive Narrative: RWA tokenization is a hot trend, and Rexas pitched itself as a front-runner. The problem: no working product to back the vision.

Community Mood

On X and other platforms, Rexas is branded a “walking red flag” and accused of “farming holders.” Skepticism outweighs optimism by a mile, though the lack of hard proof leaves room for doubt.

The Bottom Line

Rexas Finance might not be a textbook rug pull, but its lack of transparency, misleading presale practices, and reliance on hype over delivery make it a high-risk, possibly scam-like project. The collapse in token price and flood of negative user reports only deepen those suspicions.

If You’re Already Exposed

- Stop engaging with the platform to avoid being manipulated further.

- Collect evidence—transaction IDs, emails, wallet addresses.

- Report to local regulators or fraud prevention bodies.

- Contact your bank for possible chargebacks.

- If the losses are significant, consider professional recovery services.

Staying Safe in the Future

Crypto is full of promises, but scams often wear the same mask: big giveaways, anonymous teams, “guaranteed” returns. Always dig deeper—verify regulation, check team credibility, demand working products, and never invest more than you’re willing to lose.

Investor Takeaways

The story of Rexas Finance is a reminder of how quickly hype can inflate and just as quickly deflate in the crypto world. The project’s mission—democratizing access to real-world assets through blockchain—is undeniably attractive.

Its presale success proved that there is appetite for such innovation. Yet its failure to meet expectations, coupled with poor transparency and a lack of working products, has left the project struggling to maintain credibility.

For investors, caution is essential. Any potential involvement with RXS should be preceded by careful research into exchange listings, contract audits, and the team’s legitimacy. Lofty predictions of multi-dollar valuations should be treated skeptically, given the market volatility and competitive challenges.

Ultimately, Rexas Finance’s future will hinge not on its marketing campaigns but on whether it can build the ecosystem it promised and regain the trust it has lost.

Conclusion

Rexas Finance represents both the promise and the peril of the crypto market. In its vision, it captured the imagination of investors, and in its presale success, it proved the appetite for real-world asset tokenization is real. But the spectacular crash of its token has exposed the dangers of speculation, hype-driven trading, and overpromising without execution.

For now, RXS stands as a cautionary tale—a reminder that in crypto, fortunes can change overnight, and only projects that deliver real value will endure the test of time.

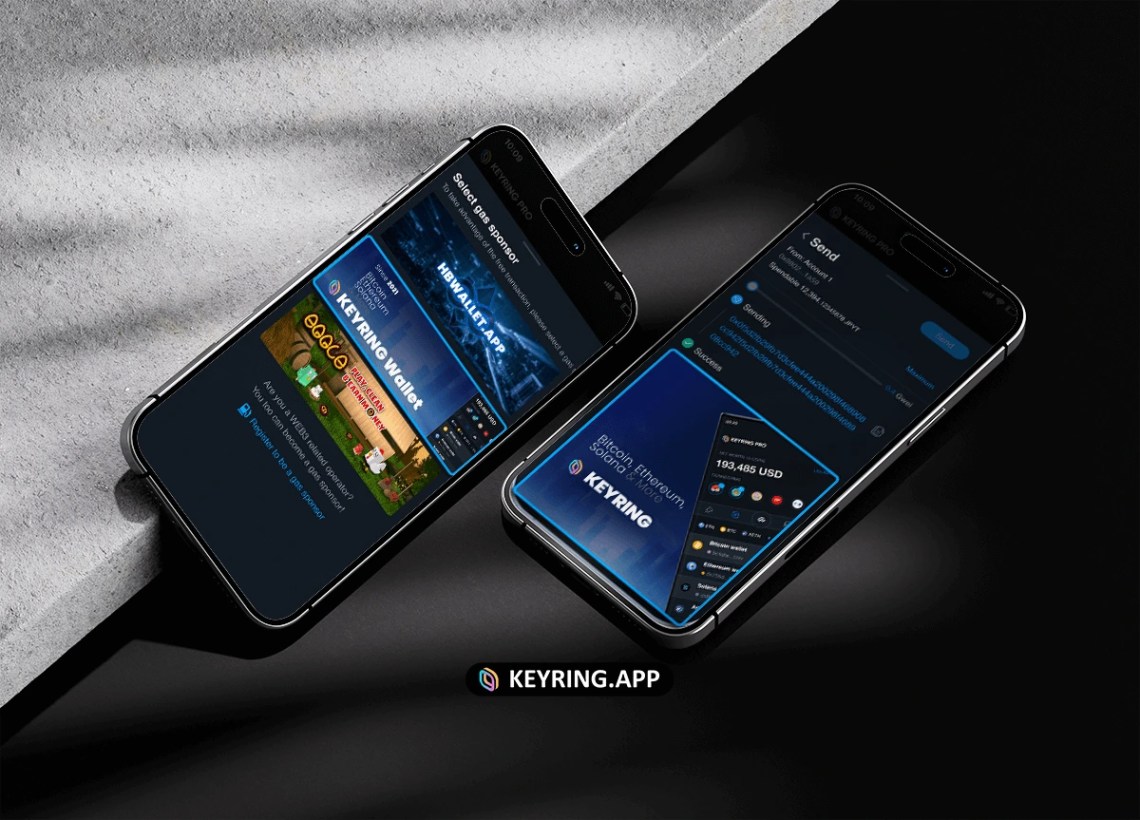

KEYRING PRO Wallet – Manage Your Assets, Your Way

When you go on-chain, there’s one essential tool you can’t do without: a Web3 wallet. That’s why the market is overflowing with different wallets—each with its own flavor, each built for a certain type of user.

But here’s the catch: too many options can be just as bad as too few. Things get messy, overwhelming, and sometimes you’re left wondering: which wallet should I even trust?

That’s where KEYRING PRO Wallet steps in. It’s powerful, versatile, and packed with features—yet still incredibly simple to use.

With KEYRING PRO, you get:

- Multichain Freedom: Create and link wallets across multiple chains, organize them by chain or asset value, name them, group them—your wallet, your rules.

- Built-in Exchange: Swap and bridge assets right inside the app, no extra tabs, no friction.

- Real-time Market Tracking: Watch prices move, spot growing tokens, and make smarter decisions with live insights.

- Gas Fee Sponsorship: A fresh innovation—your gas fees can be covered by sponsored banners. You save on fees, while sponsors reach real users with real demand.

And that’s just the start. With more features rolling out, KEYRING PRO Wallet is here to elevate your on-chain experience.

So why juggle multiple wallets when you can keep it simple? Download KEYRING PRO Wallet today and experience the difference.