How Dangerous Is Sybil Attack in Blockchain?

Blockchain promised open, trustless systems where everyone is equal. But that very openness creates a weakness: when identities are cheap and anonymous, one actor can pose as many. This is the Sybil attack—one entity controlling multiple identities to distort fairness, governance, tokenomics, and ultimately trust.

This article explores the concept, origins, real-world cases, impacts, and defenses against Sybil attacks in blockchain.

What is a Sybil Attack?

A Sybil attack occurs when one actor creates and controls many identities (wallets, accounts, nodes) and uses those fake personas to influence or manipulate the behavior of a distributed system. In permissionless blockchains, creating additional addresses is trivial and cheap—this low cost of identity creation is what makes Sybil attacks especially feasible and attractive.

Mechanically, a Sybil attacker will:

- Spin up a large set of addresses or nodes.

- Make those identities appear to act independently.

- Use the apparent numerical advantage to sway outcomes that rely on distributed participation—voting, airdrop eligibility, reputation systems, or even network-level behaviors.

The goal can be financial (farm tokens and sell), governance (push proposals that benefit the attacker), or disruptive (spam the network and raise costs for legitimate users).

The academic formalization of the problem shows that without a trusted central identity authority—or some other strong uniqueness resource—Sybil attacks are always a practical threat in distributed systems.

Origin of the Term

The label “Sybil” traces back to the 1973 book Sybil by Flora Rheta Schreiber, the dramatized case of a woman known by the pseudonym Sybil Dorsett who reportedly exhibited multiple personalities. Computer scientists borrowed the metaphor to describe a situation where one entity behaves as many.

In 2002 John R. Douceur crystallized the concept in a seminal paper, The Sybil Attack, which proved that redundancy-based defenses in distributed systems break down if a single adversary can present multiple identities.

Douceur’s core insight—Sybil attacks are a fundamental weakness of open, identity-cheap systems—remains central to how we think about blockchain security today.

Why Blockchains Are Particularly Vulnerable

Several design features that make blockchains powerful also make them fertile ground for Sybil attacks:

- Permissionless participation. Anyone can create wallets or run nodes without proving a unique human identity.

- Pseudonymity. Addresses are identifiers, not verified people. On-chain activity is tied to addresses, not verified humans.

- Incentive structures. Airdrops, liquidity mining, bounty programs, and governance rewards create strong financial incentives for exploiting any loopholes.

- Low marginal cost. Scripts and automated tooling make generating thousands of addresses and transactions cheap.

- Difficulty of attribution. Linking on-chain addresses to single real-world actors is often nontrivial, particularly when attackers use mixing, vanity addresses, or compromised accounts.

Together, these factors create a cost/benefit equation that often favors attackers, especially against projects that rely on simple snapshot-based eligibility checks or that measure “activity” in ways easily gamed.

How Sybil Attacks Play Out in Web3 — Common Patterns

- Airdrop Farming: Attackers spin up many wallets, mimic user activity (swaps, trades, bridging), and capture outsized airdrop allocations. Tokens get dumped, draining value from real users and depressing prices.

- Governance Manipulation: In DAOs, Sybils split holdings or control multiple wallets to sway votes, undermining legitimacy and enabling coordinated capture.

- Reputation Fraud: On marketplaces and social platforms, fake identities inflate ratings, falsify activity, or sabotage competitors.

- Spam & Gas Warfare: Mass low-value transactions clog the mempool, drive up fees, and distort activity metrics—raising costs for genuine users.

- Node-Level Attacks: Less common but severe: fake nodes attempt to partition networks, disrupt block propagation, or bias peer selection. Cloud resources and botnets make such attacks feasible.

Top Solana NFT Marketplaces & How to Manage Your Portfolio with KEYRING NFT Viewer – KEYRING PRO

Real-World Examples: Airdrops, Arbitrum, and the Industry Wake-Up Call

Airdrop farming and Sybil exploitation have been documented across multiple high-profile distributions. Researchers and journalists reported substantial Sybil activity around large token distributions, forcing projects to retroactively exclude suspicious addresses and tighten eligibility rules.

One highly publicized case involved Arbitrum’s ARB airdrop, where analyses suggested tens to hundreds of thousands of addresses were either Sybil clusters or controlled by a small number of entities; estimates put a material share of distributed tokens into questionable hands.

The incident highlighted how sophisticated farm operators—using automation, vanity-address hacks, and coordinated behavior—can capture sizable portions of airdrops. Projects scrambled to develop anti-Sybil detection and mitigation methods in response.

Across the industry, airdrop abuse prompted projects to move away from simple snapshot models and toward more nuanced, behavior-based eligibility checks—yet attackers continued to adapt.

The Broader Damage: Economic, Social, and Technical Effects

Sybil attacks don’t just let bad actors pocket free tokens — they create systemic harm.

Economic Distortion

- Token leakage. Tokens intended to bootstrap real user engagement are siphoned to farm operators and quickly sold, creating downward price pressure.

- Wasted allocation. Projects dedicate scarce token supply to fake participants, diluting incentives for real contributors.

- Increased distribution costs. Teams spend time and money reworking tokenomics and conducting forensic analyses.

Degraded Governance & Protocol Security

- Compromised governance. Decisions driven by fake participation can lead to proposals that favor attackers or break protocol invariants.

- Consensus risk. In blockchains where node participation correlates to influence, malicious clustering can raise security questions.

Reputation & User Trust

- Community erosion. Legitimate participants feel cheated when rewards go to farms; long-term engagement suffers.

- Brand damage. Projects labeled as “easily farmed” struggle to attract meaningful long-term users and partners.

Operational Costs & Friction

- KYC and friction. Projects may add identity checks to fight Sybils, but that raises user onboarding friction and conflicts with permissionless values.

- Analytics arms race. Teams must invest in on-chain analytics and anti-Sybil tooling, which is costly and never perfect.

Distorted Metrics

-

False growth signals. Inflated “active user” counts and engagement metrics mislead investors, partners, and product teams, masking a fragile user base.

Collectively, these harms compound—more Sybil success leads projects to add heavier friction, which in turn discourages casual genuine users and concentrates influence among those who can clear higher barriers.

Detecting Sybil Behavior: Signals and Techniques

Detecting Sybil attacks is part science, part art. Common signals used in detection include:

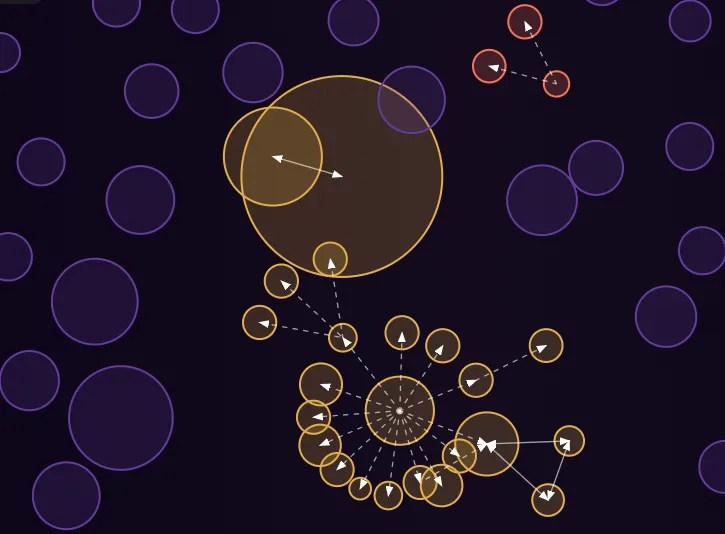

- Wallet clustering. Heuristics that group addresses by shared behavior: same funding source, reused contract patterns, correlated transaction timing.

- Activity fingerprints. Identical or nearly identical transaction sequences across many addresses suggest automated farms.

- Topological analysis. Graph analytics that reveal dense subgraphs or communities of addresses that interact disproportionately with each other.

- Device/IP correlation. Off-chain signals like shared IPs or device fingerprints (when available) help reveal actor centralization.

- Temporal patterns. Batch creation timestamps, synchronized transactions, or recurring windowed activity suggest automation.

Advanced detection combines multiple signals with machine learning to generate Sybil risk scores. But every detection technique has false positives and false negatives; attackers evolve, and defenders must constantly refine heuristics.

The Best Solana NFT Marketplaces in 2025 and How to Use the Solana Faucet – KEYRING PRO

Mitigation Strategies: Tradeoffs and Practical Defenses

There is no single solution to Sybil attacks. Effective defenses rely on combining multiple layers—economic, technical, and social. The challenge is balance: too weak, and Sybils overwhelm the system; too strict, and blockchain’s permissionless ethos gets eroded.

Adaptive Airdrop Design

Airdrops are prime Sybil targets, so distribution models must evolve. Progressive reward schedules incentivize long-term engagement instead of one-off snapshots.

Behavior-based gating requires diverse actions over time—trading, liquidity provision, dApp usage—making it harder and costlier to fake activity at scale.

Finally, allocation caps and throttles prevent a single entity (whether one wallet or a cluster) from capturing outsized rewards. Together, these tools shift incentives toward genuine users.

Identity and Social Proof

Another defense is tying eligibility to harder-to-fake signals. Social verification links participation to Twitter accounts, Discord histories, or GitHub activity, raising friction for farms.

More advanced are decentralized identity solutions such as soulbound tokens, DIDs, or verifiable credentials. These embed non-transferable uniqueness into user profiles but raise questions about privacy, interoperability, and who controls the verification process.

Proof-of-Personhood & Human Verification

Emerging systems attempt to prove human uniqueness without revealing personal data. Some rely on interactive challenges or web-of-trust models like BrightID.

Others use more controversial biometric approaches, such as iris scans. Each carries tradeoffs: challenges can be gamed, webs-of-trust require community buy-in, and biometrics raise centralization and privacy concerns.

On-Chain Forensics and Analytics

Sybil activity leaves patterns on-chain. Clustering wallets by funding sources, timing, or transaction behavior often reveals suspicious groups.

Many projects now partner with analytics firms or use open-source tools to flag Sybil clusters before distribution. Post-distribution audits allow teams to claw back allocations or blacklist wallets. These methods are reactive but still raise costs for attackers.

KYC for High-Risk Distributions

For high-stakes distributions, some projects adopt Know Your Customer (KYC) checks. This virtually eliminates Sybils but comes with steep tradeoffs: reduced privacy, slower onboarding, and added compliance burdens.

KYC remains controversial in crypto, yet in contexts like governance tokens, it can be the most pragmatic defense.

Economic Disincentives

Another strategy is to make Sybils expensive. By requiring staking, bonding, or tying identity to scarce resources, projects force attackers to commit real capital.

If abuse is detected, that capital can be slashed or locked, shifting the cost-benefit equation heavily against Sybil farming.

Community Review and Bounties

Communities can also play a role. Open claim windows combined with bounty programs reward users who detect and report Sybil clusters.

This not only strengthens defenses but also builds trust, as participants feel directly involved in protecting the ecosystem.

Solana Seeker Airdrops! Are The Airdrops Worth The Wait? – KEYRING PRO

The Tradeoff: Openness vs. Defense

Every strategy introduces friction. Social proofs deter anonymous users. Forensics is costly and imperfect. KYC undermines permissionlessness. Proof-of-personhood carries centralization risks.

Yet without defenses, Sybils siphon value and destroy trust. Each project must choose its balance: ideological purity with full openness, or pragmatic defenses that protect real users at the cost of some friction.

The most realistic path forward is a layered approach—combining adaptive incentives, forensic monitoring, identity signals, and community participation. Only through this mix can projects make Sybil attacks less profitable, less scalable, and less damaging.

Case Study: How Arbitrum and Others Responded

When major airdrops showed signs of Sybil capture, teams experimented with multiple countermeasures: on-chain clustering, off-chain manual review, and revised eligibility rules. Some projects opted to exclude suspicious addresses entirely; others retroactively adjusted allocations or extended distribution windows tied to long-term engagement.

These efforts illustrate the reactive nature of current defenses: projects typically discover sophisticated farming only after the fact, then must spend significant resources to analyze and remediate. The result is a repeated cycle where attackers adapt faster than one-off defenses can scale—highlighting the need for proactive, layered systems of resistance.

What Projects Should Do Today (Practical Checklist)

- Design token distributions that reward persistence over snapshots.

- Implement multi-signal Sybil detection pre- and post-distribution.

- Set reasonable caps per address and review edge cases manually.

- Use social proofs and verifiable credentials where possible.

- Collaborate with analytics partners and the wider community.

- Document and publish your anti-Sybil policy to set expectations.

- Monitor markets and be prepared to claw back or freeze suspicious allocations.

Advice for Users Who Don’t Want to be Flagged as Sybil

- Act consistently. Use projects regularly; don’t just churn small transactions around snapshot times.

- Vary activity. Trade, stake, provide liquidity, and interact with the protocol in realistic ways.

- Avoid mass-creating addresses with identical behavior. That’s the fastest path to being flagged.

- Keep records. If you are a legitimate multi-wallet user, maintain logs and proofs of genuine activity.

Looking Ahead: Research and Emerging Defenses

The Sybil problem sits at the intersection of economics, identity, privacy, and distributed systems. Promising directions include:

- Zero-knowledge identity proofs that prove uniqueness without revealing identity.

- Hybrid on-chain/off-chain attestations where trusted verifiers assert human uniqueness without centralization.

- Economic mechanisms that tie identity creation to scarce resources or time-based staking.

- Improved community governance that uses reputation over token counts.

None of these is mature yet; the field is actively evolving as attackers innovate. Continued academic work, tooling improvements, and cross-project collaboration will be crucial.

Lessinvest.com Crypto Review: Where to Find Reliable Info Sources – KEYRING PRO

Conclusion

Sybil attacks aren’t just theory—they cause real economic loss and weaken blockchain systems. Cheap, anonymous identities let attackers farm value, rig governance, and erode trust.

Defenses exist—smarter airdrop design, forensics, social verification, new identity models—but stronger protection often means less openness. The real challenge is balance: keeping blockchains decentralized while ensuring unique, trustworthy participation.

In the end, decentralization without verifiable human uniqueness is fragile. To scale, blockchains must make honesty cheap and Sybil attacks costly.

KEYRING PRO Wallet – Manage Your Assets

When you step into the world of blockchain, crypto, and Web3, a wallet isn’t just an option – it’s a necessity. That’s why the market is overflowing with Web3 wallets.

The problem? Too much choice can backfire. Flashy designs, complicated features, clunky navigation — they can make managing your assets more stressful than it needs to be.

KEYRING PRO Wallet changes that.

It gives you the best of both worlds: a clean, user-friendly interface that anyone can navigate, plus a full toolkit of features from basic to advanced. Whether you’re just starting out or you’re a seasoned crypto native, KEYRING PRO Wallet makes asset management simple, secure, and powerful.

Ready to take control of your digital assets?

Download KEYRING PRO Wallet now and experience Web3 the way it should be.