Is Staking and Delegating Crypto the Same Thing – What You Need to Know

Cryptocurrency staking and delegating are essential concepts in the world of blockchain, particularly for Proof-of-Stake (PoS) networks. While they are closely related, they serve different purposes and involve different levels of commitment and responsibility.

In this article, we’ll break down Is Staking and Delegating Crypto the Same Thing? – the differences, when to stake, when to delegate, and the pros and cons of each. Additionally, we’ll cover important terms, key risks, and strategies to maximize staking rewards.

Is Staking and Delegating Crypto the Same Thing?

What is Staking?

Staking is the process of locking up a certain amount of cryptocurrency to support the operations and security of a blockchain network. In return, participants (stakers) earn rewards in the form of additional coins or tokens.

This process replaces the traditional Proof-of-Work (PoW) mining model with a more energy-efficient approach, allowing users to participate in network validation without the need for expensive hardware.

How Staking Works

- Users lock their tokens in a staking contract or wallet.

- The staked tokens are used to validate transactions and secure the network.

- The blockchain rewards stakers based on the amount of crypto staked and the network’s specific reward system.

- Stakers may have to follow an unstaking period before withdrawing funds.

- Some networks implement governance rights, allowing stakers to vote on network decisions.

- Rewards vary based on the network’s inflation rate and total staked supply.

What is Delegating?

Delegating is a subset of staking where users assign their staking power to a validator or staking pool without directly participating in the validation process. It allows users to earn staking rewards without having to operate a node themselves.

How Delegating Works

- Users choose a validator or staking pool and delegate their tokens to them.

- The validator takes responsibility for securing the network and processing transactions.

- The validator distributes staking rewards to delegators after taking a commission.

- Delegators maintain ownership of their tokens but cannot use them while they are staked.

- If a validator misbehaves or is slashed, delegators may also lose a portion of their rewards or staked assets.

- Delegators can redelegate to another validator or unstake their tokens after a lock-up period.

Key Differences Between Staking and Delegating

When Should You Stake?

- If you have the technical knowledge and resources to run a validator node.

- If you want to maximize your staking rewards without sharing them with a validator.

- If you are committed to the network and understand the risks of slashing (penalties for validator misbehavior).

- If you want to actively participate in governance decisions.

- If you are comfortable managing private keys and network uptime requirements.

When Should You Delegate?

- If you want to participate in staking without managing a node.

- If you prefer a passive income approach with minimal effort.

- If you trust a specific validator or staking pool to perform efficiently.

- If you are a beginner in crypto staking and want to learn without taking on too much risk.

- If you are diversifying your staking portfolio across multiple validators to reduce risk.

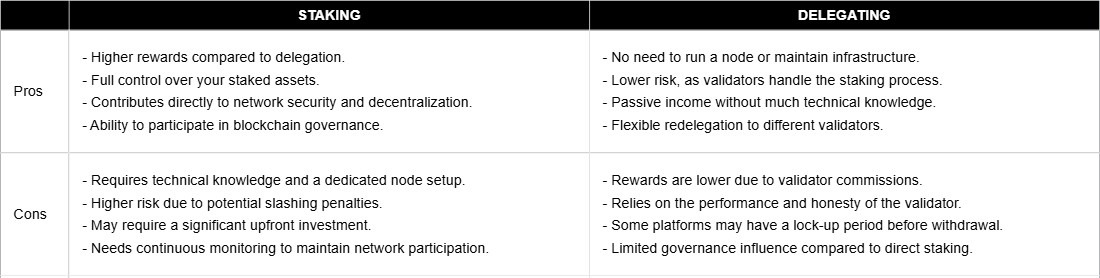

Pros and Cons

Staking Pros and Cons

Pros:

- Higher rewards compared to delegation.

- Full control over your staked assets.

- Contributes directly to network security and decentralization.

- Ability to participate in blockchain governance.

Cons:

- Requires technical knowledge and a dedicated node setup.

- Higher risk due to potential slashing penalties.

- May require a significant upfront investment.

- Needs continuous monitoring to maintain network participation.

Delegating Pros and Cons

Pros:

- No need to run a node or maintain infrastructure.

- Lower risk, as validators handle the staking process.

- Passive income without much technical knowledge.

- Flexible redelegation to different validators.

Cons:

- Rewards are lower due to validator commissions.

- Relies on the performance and honesty of the validator.

- Some platforms may have a lock-up period before withdrawal.

- Limited governance influence compared to direct staking.

Key Risks of Staking and Delegating

- Slashing Risk: If a validator acts maliciously or fails to meet network requirements, a portion of their staked assets may be slashed, leading to losses for stakers and delegators.

- Validator Misbehavior: Choosing an unreliable validator can result in missed rewards and potential penalties.

- Liquidity Issues: Staked assets are typically locked up and cannot be accessed immediately.

- Market Volatility: While earning rewards, the value of the staked cryptocurrency may fluctuate significantly.

- Network-Specific Rules: Different blockchain networks have different staking mechanisms, rewards, and penalties.

Strategies to Maximize Staking Rewards

- Research Validators: Choose reputable validators with a track record of reliability and low commission fees.

- Diversify Delegations: Split your stake across multiple validators to reduce risk.

- Check Fees: Some validators charge high commissions, reducing your net rewards.

- Consider Liquid Staking: Some platforms offer liquid staking tokens that can be used elsewhere while still earning staking rewards.

- Stay Updated: Keep track of network changes, governance proposals, and validator performance.

Other Terms You Should Know

To fully understand staking and delegation, it’s helpful to be familiar with the following terms:

- Validator – A participant in a PoS network that verifies transactions and adds new blocks.

- Slashing – A penalty imposed on validators (and sometimes delegators) for malicious activity or downtime.

- Unstaking Period – The time required to unlock staked assets before they can be withdrawn.

- APR (Annual Percentage Rate) – The expected return on staking over a year.

- Liquidity Staking – A method that allows users to stake tokens while still maintaining access to liquidity through derivative tokens.

- Staking Pool – A group of users who combine their stakes to increase their chances of earning rewards.

- Self-Staking – When a user stakes their own tokens without delegation.

- Governance Staking – Some networks allow stakers to vote on proposals that affect the blockchain.

- Re-Staking – Compounding staking rewards by re-staking earned tokens.

- Custodial vs. Non-Custodial Staking – Some platforms require users to transfer assets (custodial), while others allow users to stake directly from their wallets (non-custodial).

Conclusion

While staking and delegating are closely linked, they serve different roles in the PoS ecosystem. Staking is for those who want full control and are willing to take on technical and security responsibilities.

Delegating is a simpler option for users who want to earn rewards without managing a node. Understanding the differences, risks, and strategies can help you make an informed decision about how to participate in blockchain networks effectively.

Whether you stake directly or delegate, both methods contribute to the security and efficiency of decentralized networks, making them essential components of the blockchain space.

> How to Join Monad Testnet- Monad Airdrop Guide – KEYRING PRO

How KEYRING PRO Wallet Helps You Manage Staked Assets

While KEYRING PRO Wallet does not directly facilitate staking or delegation, it provides a secure and efficient way to manage your staked assets. Here’s how it enhances the staking experience:

- Secure Asset Management: Store and track your staked assets across multiple blockchain networks in a single, non-custodial wallet.

- Multi-Chain Support: Easily manage staked tokens from different PoS blockchains without needing multiple wallets.

- Transparent Reward Tracking: Monitor staking rewards in real-time and stay informed about your earnings.

- Validator Selection Assistance: Use KEYRING PRO Wallet to research and interact with staking providers while keeping full control over your assets.

- Non-Custodial Security: Unlike centralized exchanges, KEYRING PRO Wallet ensures that you always retain control over your private keys and funds.